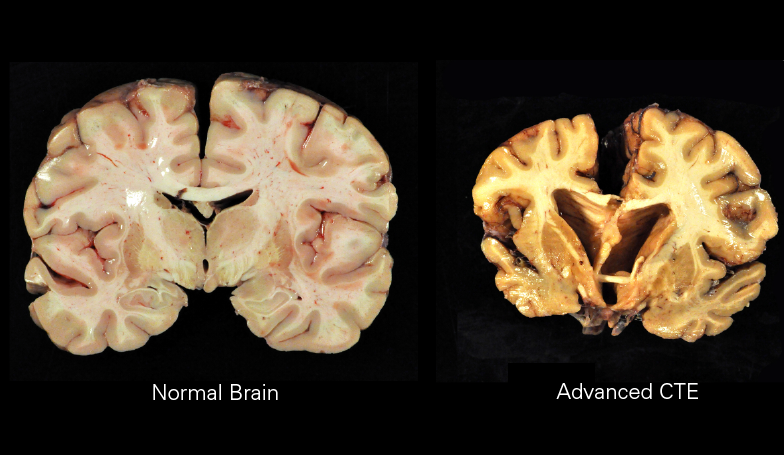

A large number of former National Football League (NFL) players have been diagnosed with or have had chronic traumatic encephalopathy, or CTE. A definitive diagnosis so far can be made only post-mortem. However, an increasing number of former players are reporting symptoms of CTE. According to 2017 study on brains of deceased gridiron football players, 99% of tested brains of NFL players, 88% of Canadian Football League (CFL) players, 64% of semi-professional players, 91% of college football players, and 21% of high school football players had various stages of CTE. However, this study had several limitations, including possible selection bias as families of players with symptoms of CTE are far more likely to donate brains to research than those without signs of the disease. Despite the limitations, the study still showed that CTE is far more common than once believed.